A Green Energy Powerhouse That Burns More Investors Than Biomass

Ventus Energy markets itself as a green crowdfunding platform, offering retail investors up to 18% returns on loans financing renewable energy infrastructure projects. It has raised €65.8 million from nearly 5,000 investors across Europe.

Author’s note: Since publication, several new developments as well as some changes to the article took place. You can find a change log of those edits and updates at the bottom of this page.

Some companies raise capital. Some raise questions. Ventus Energy does both, and at scale: With a trail of doctored documents, insider deals, and assets bought from its own majority owner at five times fair value.

Short on time? Skip to the summary, or keep reading for the full investigation with sources.

Executive Summary

Key findings

- Ventus’s CEO doctored a valuation PDF, pasting “Ventus Energy OU” over “Crowdestor” before publishing it to investors. The edit history is still in the file.

- Ventus used retail investor money to buy the founder’s own assets at five to seven times fair value.

- Ventus raises repayable funds from nearly 5,000 retail investors despite having no lending or crowdfunding license—registered as a “web portal” with €4,166 in capital.

- In the Jugla deal, sellers got a secured IOU. The €3 million from retail investors? Available for “fees and costs.”

- Seven influencers received equity in Ventus. Five didn’t disclose this when recommending the platform.

In December 2024, Ventus Energy raised retail investor money to finance what it called “the Ventus Energy office property purchase” at Vīlandes 6 in Riga. It failed to mention one minor detail:

This is the Crowdestor office, headquarters of the failed P2P platform founded by Ventus majority owner Jānis Timma, where 69% of loans are in recovery.

Ventus didn’t just omit this. CEO Henrijs Jansons doctored the valuation PDF, pasting ‘Ventus Energy OU’ over ‘Crowdestor’ before publishing it to investors.

And there are tapes. Well, PDFs: He forgot to flatten the file before sending it out.

This wasn’t an isolated lapse. Registry data, loan agreements, and EU regulations reveal a pattern of self-dealing, undisclosed risks, and a funding structure Ventus claims is legal but which resembles unlicensed public fundraising.

Buying His Own Asset at 72x Earnings

Timma has controlled the Powerhouse Dambis biomass plant through holding companies since 2015. In August 2024, ownership shifted on paper, though he remained head of the board. Six months later, Ventus raised €6.36 million from retail investors to acquire it. The plant earned €88,309 in 2024 and its profits never exceeded €126,185 in a normal year. Fair value: under €1.25 million. Ventus investors paid five to seven times that.

Ventus Paid With an IOU. Then Raised €3 Million to Cover … Their Fees?

Ventus raised €3 million for Powerhouse Jugla. The 49% equity buffer is pledged to the sellers for €9.65 million. Investors provided the only actual cash, and it wasn’t for the asset.

Influencers on the Cap Table

Seven P2P bloggers and influencers who promote the platform became shareholders. Five of them didn’t disclose this on their Ventus reviews. Ventus is on the record as stating equity was used to pay for coverage.

A €65 Million Platform With the Regulatory Standing of a WordPress Blog

Ventus Energy Group OÜ, counterparty to €65.8 million in loans, has €4,166 in capital, zero employees, no filed accounts, and is registered as a “Web Portal.” Under Estonian law, taking repayable funds from the public requires a license. Ventus has none, yet publicly solicits thousands of investors across 25+ countries to lend to an unlicensed company buying assets from its founder’s network.

Legal identity & basics

Ventus Energy is operated by Ventus Energy Group OÜ (registry code: 16964065), an Estonian company founded in 2024 with share capital of just €4,166. The company is registered as “Web portal activities” (EMTAK 63121) and has three shareholders: Jānis Timma (65%), SIA WIN WIN INVESTMENTS (20%), and VENTUS Employee and Partnerships Stock Options OÜ (15%). There are two people with right of representation: Henrijs Jansons and Jānis Timma. Source: https://ariregister.rik.ee/eng/company/16964065/Ventus-Energy-Group-O%C3%9C

Ventus Energy Group owns 100% of multiple Estonian SPVs, each capitalized at €100, that serve as project-level holding companies.

- VENTUS Electricity and Heat Jugla OÜ (17012252)

- VENTUS Eco Heat OÜ

- VENTUS Electricity and Heat OÜ (17180236)

- VENTUS BESS OÜ

- VENTUS W1nd OÜ (17211787) (regia.ee)

Source: https://regia.ee/en/entity/16964065-ventus-energy-group-ou

Loan documentation from members of the BeyondP2P Telegram group (https://t.me/beyondp2p_discussion) I reviewed show Ventus Energy Group OÜ is indeed the counterparty for loans rather than the individual SPVs, so it’s not like this is just an entity ‘in charge of the website’.

Ventus reports two different figures in its public loan statistics:

The larger number, currently €78.5 million, represents total investor commitments across the entire Ventus group, including loans raised at the level of individual project subsidiaries.

The smaller number, approximately €65.8 million, represents the portion raised directly by the parent company, Ventus Energy Group OÜ, which is the contractual counterparty for mezzanine loans.

This matters because only the parent company is actually borrowing from retail investors. The subsidiaries may appear in marketing materials, but they are not the entities signing the loan agreements, the unlicensed holding company is.

A Paper-Thin Entity That Operates Without Authorization

This structure raises some rather unpleasant questions.

Why is a company with €4,166 in capital the contractual counterparty for over €65.8 million in mezzanine loans? Source: https://ventus.energy/en/statistics (accessed November 30, 2025)

Why is it registered as ‘Web portal activities’ when Estonia has categories for lending (‘Other credit granting’), fund management, or energy production?

More fundamentally: Is this even legal?

What the Law Says

The Estonian Credit Institutions Act is explicit: “A company who wishes to receive cash deposits or receive other repayable funds from the public in any other manner must hold a corresponding authorisation.” The Estonian Financial Supervision Authority confirms that only businesses with a Finantsinspektsioon license may take funds from the public.

Ventus Energy Group OÜ holds no such authorization. It is not registered with Finantsinspektsioon. It does not appear in the ESMA register of authorized crowdfunding service providers. Yet it solicits “loans” from retail investors across 25+ European countries: Germany, France, Spain, Netherlands, and beyond.

Ventus might argue they’re not “taking deposits”, they’re “borrowing.” But the law covers “other repayable funds from the public,” which is precisely what these loan agreements represent. The investor gives money; Ventus promises to repay it with interest. That’s a repayable fund from the public.

The EU Crowdfunding Regulation (ECSP) offers no escape either. It explicitly states that “crowdfunding service providers should be prohibited from taking deposits or other repayable funds from the public, unless they are also authorised as a credit institution.” And separately, it prohibits platforms from having “any participation” in offerings on their own platform.

Ventus now points to the existence of a regulated investment vehicle, the Ventus Energy Fund, managed by licensed AIFM P11 Management OÜ, as if this somehow establishes that the overall structure is compliant. What Ventus does not mention is the one fact that makes this defence collapse under its own weight:

The fund cannot legally accept retail investors at all.

Under both EU AIFMD and its Estonian implementation, P11 Management is allowed to market the fund only to MiFID-defined professional investors: pension funds, insurers, banks, certain large corporations, and regulated entities. Not to the thousands of ordinary individuals Ventus raised money from. Not to investors putting in €1,000. Not even to “affluent retail” without a formal opt-up procedure and €500k+ portfolio.

In other words: It’s a regulatory costume change, not a compliance framework: when Ventus points to the AIFM-managed fund, they’re pointing to a door their own investors are not allowed to walk through.

What Ventus Claims

In an e-mail to the author on November 28, 2025, Ventus states that through “legal expert opinion (including Cobalt law firm), we determined that in Estonia it is legally permissible to raise financing ‘through a platform’ for one’s own business without a crowdfunding licence.” Further, they claim the Estonian regulator confirmed their “legal structure of attracting financing does not conflict with Estonian legislation.”

Note the careful phrasing: the structure may be permissible. Whether publicly soliciting 4,869 retail investors across 25+ countries falls within that confirmation is a different question.

Essentially, their defense is that they’re just a regular company borrowing money from thousands of strangers on the internet who just happened to arrive in neat batches of 150, without Ventus ever publicly mentioning they were raising funds.

Why That Defense Doesn’t Hold Up

A private placement exemption is limited to 150 investors per offering. This might explain why Ventus once announced exactly 1,200 investors. Not “approximately,” not “over”, exactly 1,200. Source: https://ventus.energy/en/news/acquisition-of-powerhouse-riga

That would be 8 offers times 150 investors, the precise ceiling for maintaining the exemption. To be clear: an “offer” isn’t the same as a funding round. A single round can be split into multiple offers, each capped at 150 investors, to stay within the exemption. The 1,200 figure could be coincidence or rounding, but Ventus is usually precise in its phrasing, for reasons that become apparent throughout this article.

The closed-funding exemption requires that offerings not be publicly advertised. On November 24, 2025, Jansons announced on Ventus’s Telegram that Ventus now has 4,869 active lenders. A company with a marketing website, YouTube influencer campaigns, and Telegram promotion channels boasting nearly 5,000 “investors” is not conducting private placements, it’s conducting public solicitation while claiming a private-placement exemption.

The Visibility Problem

It’s unclear whether the regulator has a full picture of how Ventus actually operates, especially since Ventus’s position is that they don’t fall under regulatory oversight at all.

Detecting otherwise requires visibility. Difficult when the company hasn’t filed a single financial statement despite being nearly 5 months overdue at the time of writing. Source; https://ariregister.rik.ee/eng/company/16964065/Ventus-Energy-Group-O%C3%9C

Regulators Took Notice Before

Whatever the regulator’s current understanding, there are signs they’ve already flagged concerns in the past. Ventus refunded its first two projects in late 2024. The company characterized this as “engagement” with Latvian and Estonian authorities. The more plausible translation: regulators flagged violations and Ventus scrambled to restructure.

Their solution was to claim “closed funding” status, as confirmed by Ventus CEO Henrijs Jansons on Ventus’s official Telegram channel on November 7, 2024.

While that may sound like a grey area, I suspect Ventus’s regulatory Tetris will not go over well once the people in charge of enforcing those regulations take a closer look.

And when they do, they might also wonder: why does a company managing €65.8 million in investor funds not have a single employee on its books? Source: https://ariregister.rik.ee/eng/company/16964065/Ventus-Energy-Group-O%C3%9C

Even in the days of AI, someone has to do the work. But if they don’t work for Ventus Energy Group OÜ, who do they work for and where are they actually based?

The Ventus blog itself offers a clue. In December 2024, it announced the purchase of “their office building” at Vīlandes 6–6 in Riga: https://ventus.energy/en/news/december-results-2024

So we have an address. But checking the Latvian registry for that address to see what company is located there, reveals something odd:

Every single company registered at this address is at least 6 years old – predating the Ventus launch by 5 years. Source: https://www.lursoft.lv/address/vilandes-iela-6-6-riga-lv-1010

You know what else predates the Ventus launch by 5 years? Crowdestor.

What’s at Vīlandes 6-6?

Multiple companies are registered at this address, but one stands out: SIA CR Investments (reg. 40203190071), founded in 2019 with the business activity “buying and selling of own real estate.”

CR Investments, now what could CR stand for?

We don’t have to guess: Latvia maintains public records of company name changes. This company has one: its previous name was SIA Crowdestor Investments. Source: https://www.lursoft.lv/previous-names/40203190071

Vīlandes 6-6 isn’t just Ventus’s headquarters. It’s Crowdestor’s operational office – the same address that appears on Crowdestor SPV filings, the same building that housed the platform’s staff.

And that street sure is a happening place. One of the auditors signing off on assets Ventus is buying? Vīlandes 7. Twenty-nine meters away.

But it doesn’t stop there…

Crowdestor

Crowdestor was a crowdfunding platform that advertised “28% and higher” returns on business and real-estate deals. Source: https://crowdestor.com/en/page/crowdestor

It’s now effectively dead. While technically still online, 69% of its €41.2 million outstanding loan book is in recovery, according to an analysis by P2P Empire. Source: https://p2pempire.com/en/review/crowdestor

Kristaps Mors, a name familiar to many veterans in the P2P industry, called it early: “Crowdestor’s business model is not sustainable.” He added his own characteristic commentary: “Investors who expected on average ~20% return from projects with no collateral, might learn that high interest = high risk. Some might also learn that investing in random crap will result in bad ROI.” Source: https://kristapsmors.com/p/interview-with-janis-timma-ceo-of

At Crowdestor, Jānis Timma owned:

- The platform (CROWDESTOR OÜ). Source: https://ariregister.rik.ee/eng/company/14388462/CROWDESTOR-O%C3%9C

- The Security Agent (CROWDESTOR SECURITY AGENT OÜ). Source: https://ariregister.rik.ee/eng/company/14386262/CROWDESTOR-SECURITY-AGENT-O%C3%9C

- Borrowers raising funds on that same platform. Source: https://crowdestor.com/en/projects/details/2889-largest-privately-held-heat-production-plant-in-riga-profit-share-offered-confidential-ii

What does a Security Agent do? Crowdestor’s Terms & Conditions define it as the entity that “manages all Loan securities (commercial pledge, mortgage, etc.) and performs debt collection on behalf of the Crowdfunding Service provider to protect the interests of Clients (Investors).” Source: https://crowdestor.com/en/page/terms

How exactly was a Timma-controlled collections agent supposed to collect from Timma-owned borrowers to repay investors on Timma’s platform?

On Crowdestor, every project page provided details on how the debt was secured (e.g. with a mortgage).

The project page about Timma’s own project linked above includes the standard “Security offered” field from Crowdestor listings. For Timma’s own project, it says: “Borrowers Corporate Guarantee”. That’s it. No commercial pledge, no mortgage, no Security Agent involvement. Just a promise from an SPV owned by the same guy who owns the platform.

The corporate structure makes this worse: As the above source shows, the security agent, the entity responsible for recovering investor funds, was actually the parent company of the entire operation. And it hasn’t filed an annual report since 2020. Nothing for 2021, 2022, 2023, or 2024.

Crowdestor investors have noted that Timma-controlled projects consistently paid on time – even as the broader portfolio collapsed. With 69% of the loan book now in recovery, this raises an obvious question: when Timma controlled the platform, the borrowers, and the segregated fund pool, what prevented him from using incoming investor funds to ensure his own projects appeared to perform?

With the annual reports of the security agent missing, it is impossible to tell what happened behind the scenes.

This matters because the pattern repeats at Ventus: Timma owns the platform, Timma owns the assets being sold to investors, Timma controls who gets repaid, and regulatory filings remain optional.

It also matters, because on July 15th, 2025, Timma posted on Telegram: “saying Crowdestor=Ventus is extremely wrong. Only connection we have as Jānis , otherwise these are completely different busineses”

‘Completely different businesses’. Are they now? Let’s have a look.

Ventus Used Investor Money to Buy The Crowdestor Office, Then Published Tampered Documents to Hide It

In its December 2024 monthly report, Ventus announced a retail lending opportunity “to finance the Ventus Energy office property purchase at Vilandes Street 6, Riga, Latvia,” with a 75% loan-to-value ratio. Source: https://ventus.energy/en/news/december-results-2024

What Ventus didn’t disclose: this is the Crowdestor office. Not a former location. Not something nearby. The actual office used by the Latvian operational core of Crowdestor. Source: https://company.lursoft.lv/en/cr-investments/40203190071

According to the official government source linked above, SIA CR Investments – the company that operated under the name Crowdestor Investments until 2023 – reported 12 employees in its most recently submitted year. That indicates a real, staffed financial-services office, not a letterbox or dormant shell. Land registry records don’t show Crowdestor as the prior owner – but this has been their operational headquarters.

They didn’t just omit this. They covered it up:

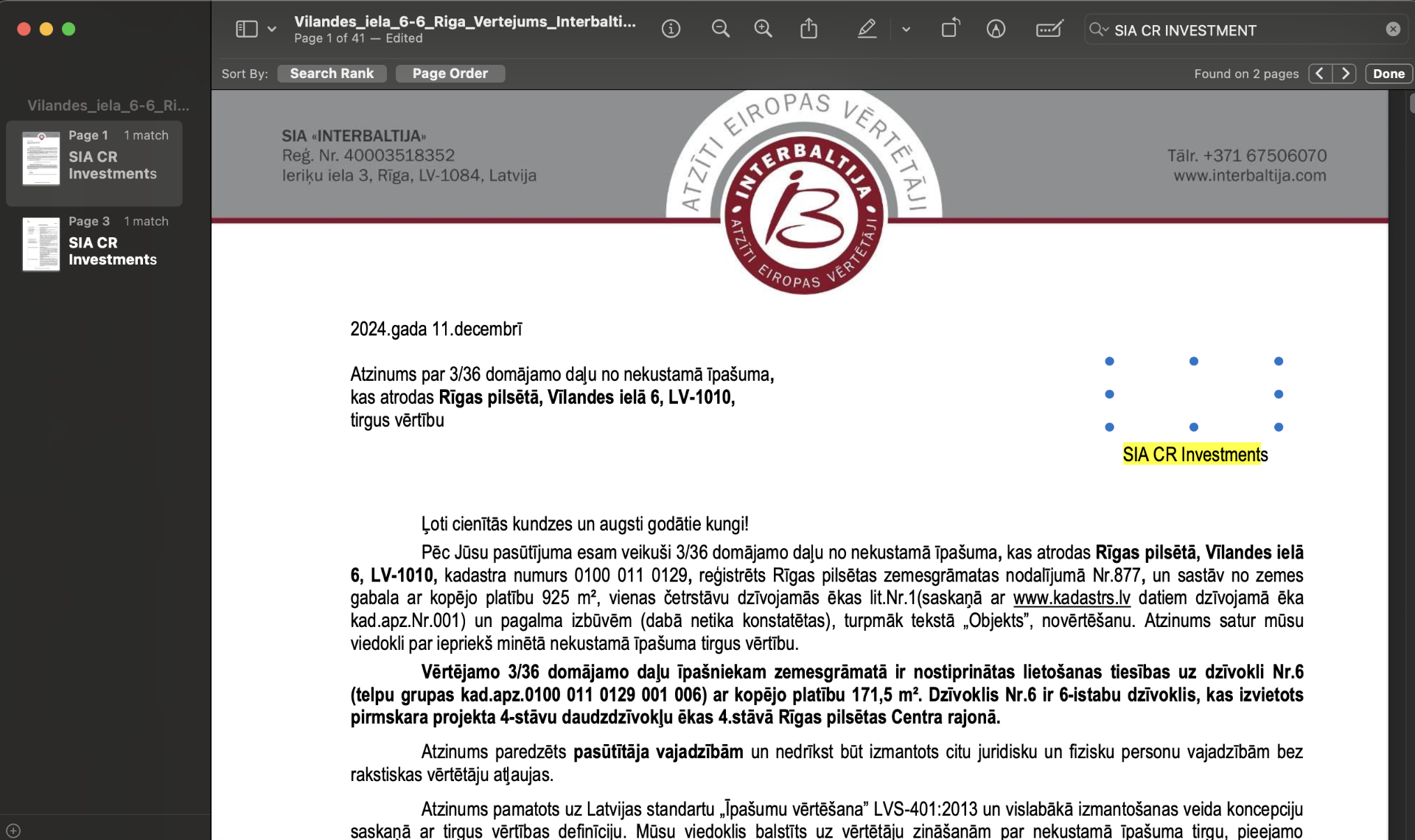

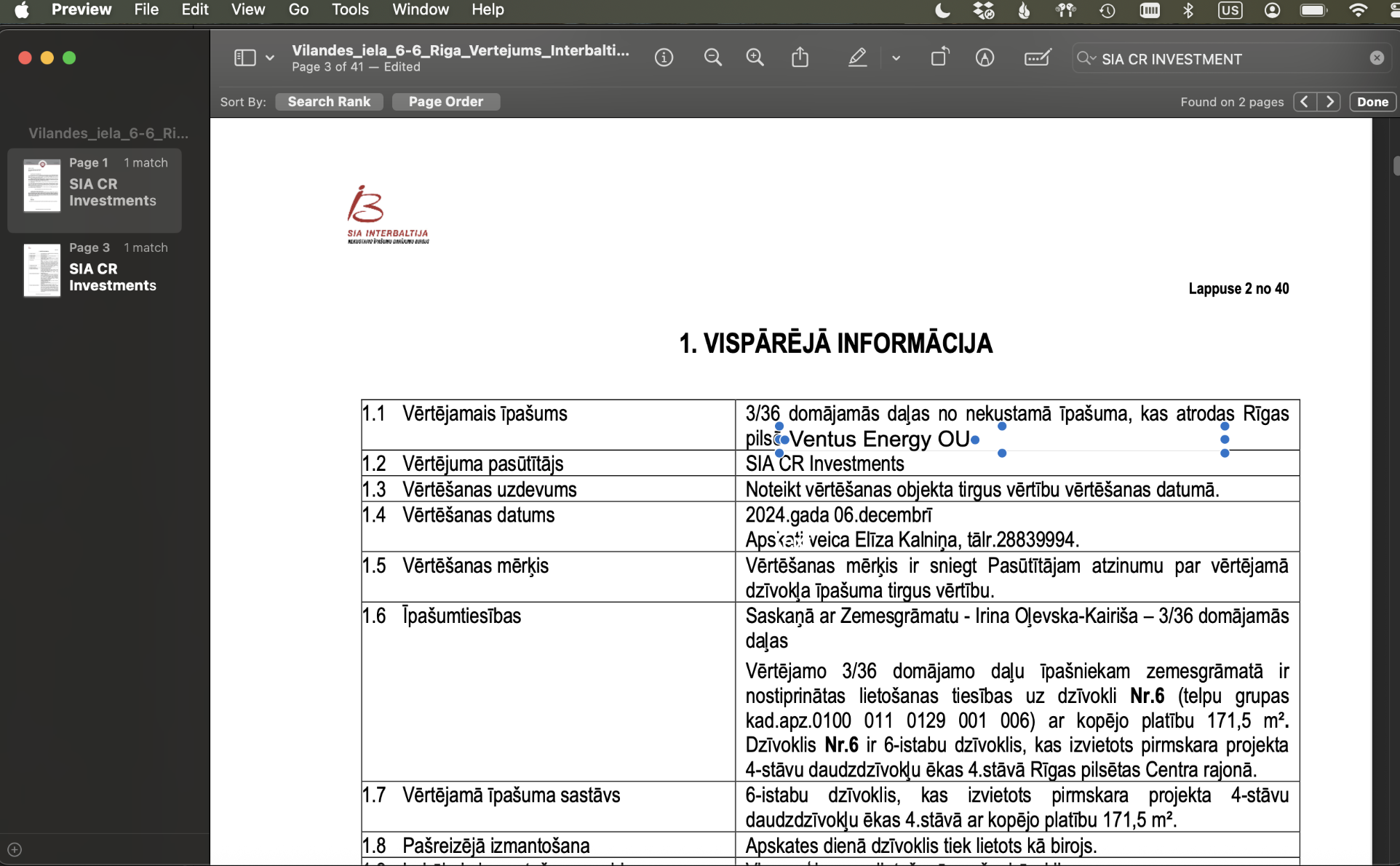

As part of the fund-raising efforts, Ventus published a valuation report. Source: https://ventus.energy/uploads/Vilandes_iela_6-6_Riga_Vertejums_Interbaltija_2024.pdf

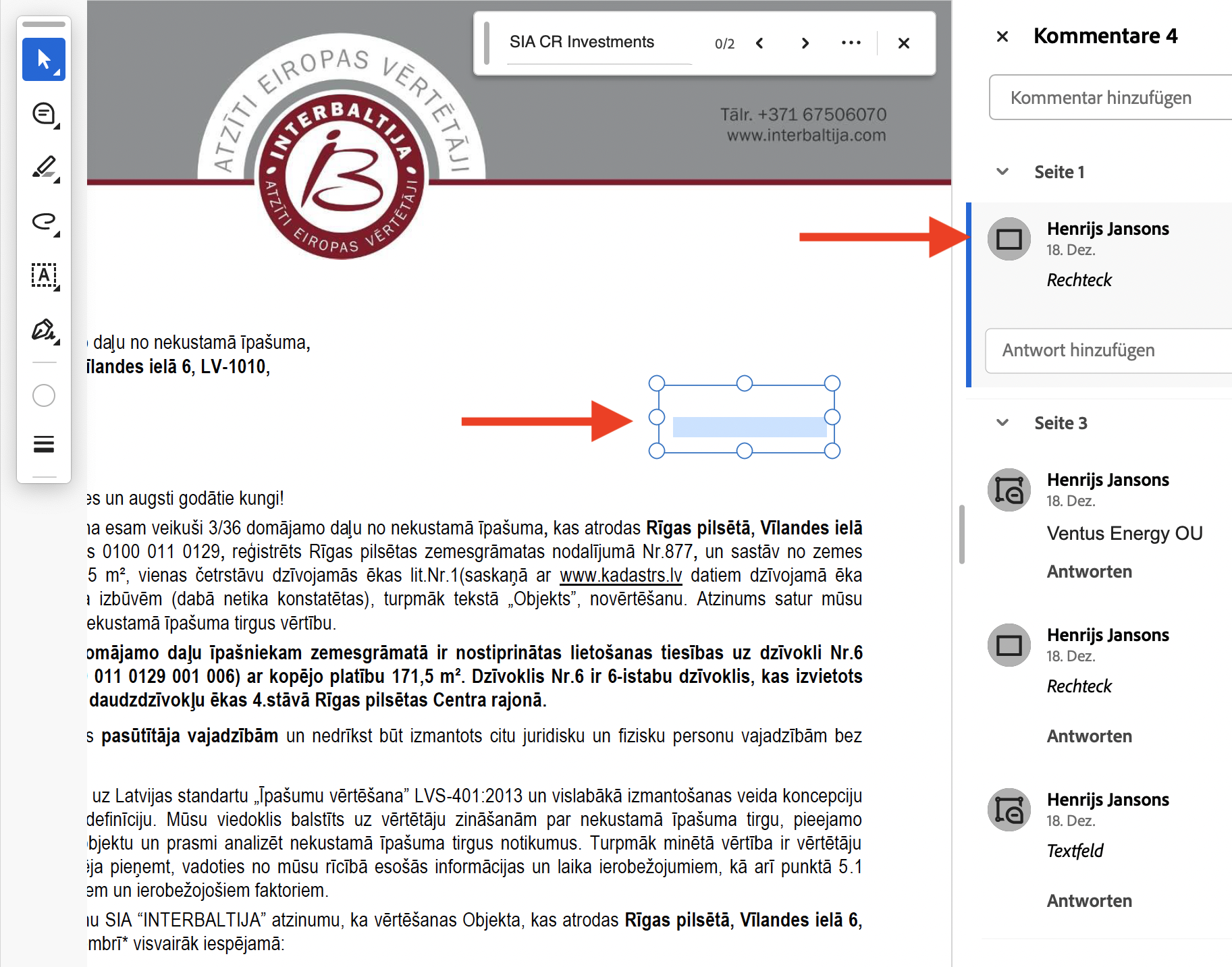

We analyzed this “valuation” PDF sent to investors. The document was not a clean export; it was a crude alteration where white boxes and new text were layered over the original data to hide the connection to Crowdestor. Because the file was not properly “flattened” before publication, the edit history remains visible inside the PDF structure.

It’s obviously possible that Ventus will remove or alter the file after publication of this article. For this purpose several time stamped forensic backups were made that would allow recreation of the exact file as it existed on the Ventus website at the time of publication.

It’s obviously possible that Ventus will remove or alter the file after publication of this article. For this purpose several time stamped forensic backups were made that would allow recreation of the exact file as it existed on the Ventus website at the time of publication.

Verify it yourself

If you didn’t have the file already, by the time you read this, the above file on the Ventus website may have been removed or altered already. Thus, if you don’t have the original file on your computer already, you can access it here:

Using that file, you can uncover the alteration yourself.

Using Adobe Reader

Enable the “Comments” panel in Adobe Acrobat or similar software. You will see the specific edits, the time stamps, and the user account “Henrijs Jansons” tagged to every redaction.

The “Comments” panel reveals exactly who made the redactions. The white rectangles used to hide the “Crowdestor” name and the text box pasting “Ventus Energy OU” over the original owner were applied by Henrijs Jansons, the CEO of Ventus Energy.

Using MacOS and Other PDF Readers

You can also open the file in most standard PDF readers and search for “sia cr investments”. You’ll find two instances: one covered with a white box, another where an image reading “Ventus Energy OU” in a mismatched font was placed on top.

Here’s how that looks (with the white and text boxes moved to show the text beneath):

And then things got worse.

Beyond the Office Building: The Powerhouse Deals

The doctored PDF wasn’t an isolated incident. Ventus has been systematically acquiring assets from Timma’s existing network, assets that previously appeared on Crowdestor.

In November 2022, Timma registered two holding companies:

- Power Capital SIA (40203444130), 100% owned by Timma: https://company.lursoft.lv/en/power-capital/40203444130

- BONO Powerhouse SIA (40203444658, 100% owned by Power Capital SIA): https://company.lursoft.lv/en/bono-powerhouse/40203444658

These companies then acquired control of multiple power plants. Power Capital took over Powerhouse Sarkandaugava (January 2023) and Powerhouse Riga (January 2023). BONO Powerhouse subsequently took Sarkandaugava from Power Capital and controlled Powerhouse Atlasa from April 2023 through March 2025.

Sources (paywalled):

One of these assets previously appeared on Crowdestor. Powerhouse Sarkandaugava was pitched as the “Largest privately held heat production plant in Riga” with an expected exit price of €4-6.7 million and target returns of 32% per year. Timma told Crowdestor investors they were funding preparation of the asset for sale to a “strategic equity investor.” Source: https://crowdestor.com/en/projects/details/2889-largest-privately-held-heat-production-plant-in-riga-profit-share-offered-confidential-ii

Registry records show these SPVs subsequently appeared under the control of SIA BONO Powerhouse, wholly owned by Timma through Power Capital SIA … and then resurfaced on the Ventus roadmap as upcoming “Powerhouse” projects for a new investor audience. Source: https://ventus.energy/en/news/meet-ventus-energy

A 2025 notification to Crowdestor investors confirmed the connection directly. The letter informed investors in the “Energy Flex [CRF-6]” and “Biomass Heating Flex [CRF-7]” projects that “Ventus Energy Group has acquired JSC White House Capital, the company that originally owned these projects, and has taken over all of its active obligations.”

This proves Timma was simultaneously:

- Founder, CEO, and owner of Crowdestor (the lending platform and its security agent)

- Owner of White House Capital (the holding company behind Crowdestor-funded projects

- Majority owner of Ventus Energy Group OÜ (the vehicle now accumulating these assets)

Ventus didn’t stumble upon appealing energy assets. From day one, it targeted the ecosystem Timma had built inside Crowdestor, not to “leverage existing knowledge,” as Ventus claims, but to facilitate insider dealing.

The clearest example is a 15 MW biomass plant.

Powerhouse Dambis: Buying Your Own Asset With Investor Money

A power plant that, energy crisis aside, has never earned more than €126,185 in a year might reasonably (and with a lot of optimism) be worth €1.2 million.

Ventus paid €6.36 million for one.

Why would Ventus overpay by a factor of five?

Maybe because Timma owned the plant before Ventus bought it with investor money?

Yep.

Here’s how.

On February 5, 2025, 173 days after Timma’s nominal ownership transfer, Ventus Energy raised retail capital to acquire Powerhouse Dambis, a 15 MW biomass plant in Riga. The acquisition price: €6.36 million. The plant’s 2024 profit: €88,309.

That’s a 72x earnings multiple for an asset that, outside of Europe’s energy crisis, has never earned more than €126,185 annually – and spent five months of 2024 shut down because it couldn’t operate profitably.

The Ownership Chain

Timma didn’t always hide his connection to this plant. In November 2020, Crowdestor published a blog post describing his personal energy holdings, explicitly naming “an operational 15 MW biomass boiler house located in Ganibu Dambis 40B” as Timma’s “skin in the game.” Source: https://crowdestor.com/en/post/energy-holding-simple-explanation

The operating company, SIA Eco Energy Riga (reg. 40103860838), sat inside AS White House Capital, a holding company Timma owned 100% from its 2015 founding through January 2024. Three months before launching Ventus, he restructured. White House Capital’s shares transferred to AS Gaisma-SD (82.5%) and SIA Power Capital (17.5%), another Timma vehicle. His name disappeared from the shareholder register, but he remained Chair of White House Capital’s board.

Then in May 2025, Ventus acquired the 22.35% stake previously held by Power Capital.

Source: https://company.lursoft.lv/en/white-house-capital/40103907861 (paywalled: see historical shareholders, beneficial owners, and management sections)

The transaction structure: Timma sold shares from one entity he controlled to another entity he controlled, funded by retail investors who were never told this was a related-party deal.

What the Financials Actually Show

Ventus told investors the plant had “consistently delivered stable revenue and profit since 2018.” Sources: https://ventus.energy/en/news/february-2025-results and https://ventus.energy/en/news/march-2025-results

The audited accounts tell a different story. Here’s the complete profit history of SIA Eco Energy Riga:

| Year | Net Profit/Loss (EUR) | Context |

|---|---|---|

| 2015 | -17,405 | Partial year (founded Jan 2015) |

| 2016 | -20,950 | Construction/development phase |

| 2017 | -54,790 | Construction/development phase |

| 2018 | -240,209 | Plant commissioned April 26, 2018 |

| 2019 | 126,185 | First profitable year |

| 2020 | -36,541 | |

| 2021 | 822,410 | Energy crisis begins |

| 2022 | 1,286,988 | Energy crisis peak / Interbaltija DCF valuation: €7.26M (Dec) |

| 2023 | 308,316 | -76% from peak |

| 2024 | 88,309 | -93% from peak / Plant shut down May–Sept (uneconomical to operate) |

| 2025 | n/a | Feb: Ventus acquisition announced (€6.36M) / May: Acquisition completed (72x 2024 earnings) |

Source: SIA Eco Energy Riga audited annual reports 2015–2024, Latvian Enterprise Register (reg. 40103860838)

Cumulative performance:

- 2015–2020: -€243,710 total losses over six years

- 2019: First profitable year (€126K), though accumulated losses not cleared until 2021–2022 energy crisis

- 2024 profit (€88K) is 30% lower than 2019 despite five years of inflation, earned in only seven months of operation

The 2022 result was an anomaly. When natural gas prices spiked, biomass heat commanded premium prices in Riga’s district heating auctions. When gas prices normalized, the premium vanished.

In 2024, management shut the plant from late May through September, for a total of five months, because auction prices fell below production cost. Which makes total sense: Who even needs heat in summer? The few people who do are easiest served by the government with their own plants. There is absolutely no reason to believe a privately owned powerplant would be able to pick up excess capacity requirements in summer. This is normal, not a one-time event as Ventus seemed to suggest at times.

The Valuation Problem

The only independent valuation ever performed on this asset was Interbaltija’s December 2022 DCF analysis, conducted at the absolute peak of a once-in-a-generation energy crisis, when the company had just earned €1,286,988 in net profit. That was ten times higher than any year before or since.

That valuation justified a €7.26 million revaluation reserve that now comprises 74% of Eco Energy Riga’s equity. Without that accounting entry, the company’s equity would be €2.6 million.

At a standard 10x multiple applied to normalized earnings (€88,000–€126,000), fair value is €880,000 to €1.25 million. Ventus investors paid five to seven times that.

BDO’s March 2024 Market Multiples report shows listed European utilities trading at an average 8.8x EV/EBITDA, with private SMEs typically trading at up to 50% lower due to illiquidity and information asymmetry. Source: https://www.bdo.nl/getmedia/d95ed79e-bf44-4f48-98bc-83238f718012/BDO-Deal-Advisory-Market-Multiples-Valuation-Trends-March-2024.pdf

Factor in single-customer dependence, seasonal operations, and zero pricing power, and reasonable multiples fall to 3 to 4x EBITDA. By any conventional methodology, €6.36 million is indefensible.

Who Gets Paid Before Investors

The SIA Eco Energy Riga Annual Reports 2017 to 2024 accounts reveal the capital structure Ventus investors actually bought into: Source: https://company.lursoft.lv/en/eco-energy-riga/40103860838 (Paywalled)

€786,998 owed to an undisclosed “natural person” (fiziskā persona)

This loan originated in 2017 at 3.5 to 5.0% interest. The principal hasn’t budged since 2018, and the company isn’t even paying interest; it just accrues: the short-term portion grew from €44,880 in 2023 to €62,998 in 2024 while the long-term amount stayed fixed at €724,000 according to SIA Eco Energy Riga Annual Reports 2017 to 2024.

Also: No collateral. I checked the Commercial Pledge Register. Source:

https://www.lursoft.lv/komerckilas/40103860838 (Paywalled)

Think about that. Someone lent €800,000 to a money-losing power plant, asked for no security, accepted below-market rates, and waited seven years without collecting anything. That’s not how outside lenders behave. These terms are consistent with related-party financing.

If this loan is owed to someone related to company ownership or management, then it would be a €800,000 mousetrap waiting for investor money to walk in. The moment it does, it snaps shut. The ‘anonymous creditor’ can then be repaid ahead of Ventus investors, quietly taking cash out of a project those investors believe they are funding for growth.

€160,943 owed to parent company AS White House Capital

Left-overs of Crowdestor debt, funnelled through parent company AS White House Capital. Due July 2027, unsecured, at 2.7 to 3.0% interest. Why less than 3% … wasn’t Crowdestor advertising 21%? Well, White House paid that much, but then subsidized the loan to its subsidiary by lending way below market rates, racking up debt.

Yes, Crowdestor claims sit in front of Ventus in a rather long line that is unlikely to ever see a Ventus investor get something.

€60,000 Dividend

With the Ventus acquisition on the horizon, it was time to milk this for everything they could. So the company declared a dividend, the first ever in fact, that shows as unpaid at year-end. That obligation to the previous owners remains on the books.

€400,000 Deferred Obligations

Money that should have been spent but wasn’t: €300,000 for sewage infrastructure, €100,000 for a truck scale. This was originally planned for 2018 to 2020 according to the 2017 report. Subsequent reports give no indication that these investments were made already.

Eco Energy Riga has a to-do list of over €1 million in debt and obligations before Ventus investors see returns, from a business that earned €88,309 last year and operated only seven months in 2024.

The Financial Restructuring

White House Capital’s annual reports in 2023 and 2024 show significant financial activity around the time of the transaction. Source: https://company.lursoft.lv/en/white-house-capital/40103907861 (paywalled)

- The company was insolvent with -€893,000 in equity at year-end 2023

- A €920,000 capital injection in 2024 (€2,500 new share capital + €917,500 share premium) restored solvency just before the Ventus acquisition

- €1.27 million in obligations classified as “other creditors” disappeared between year-end 2023 and 2024

The relationship between these financial movements and the Ventus acquisition remains unclear. Without disclosure of what the “other creditors” obligations represented or how they were discharged, investors cannot determine the true financial condition of the asset they were acquiring.

What Investors Weren’t Told

Ventus’s campaign materials for the initial fundraising disclosed none of this:

- Losses in 2018 and 2020 (despite claims of “consistent profit since 2018”)

- Timma’s 100% ownership of seller until 3 months before launch

- Acquisition at 72x trailing earnings (5 to 7x above fair value)

https://ventus.energy/en/news/february-2025-results; https://ventus.energy/en/news/powerhouse-dambis-acquisition

Summary

Ventus Energy, where Timma holds 65% ownership, raised retail investor capital to acquire an asset Timma had publicly described as his personal holding. The acquisition was structured as a purchase from entities within Timma’s network, priced at five to seven times fair value, with no independent valuation disclosed and no mention in investor communications that this was a related-party transaction.

Retail investors were asked to fund a €6.36 million acquisition of a plant that earned €88,000 last year, operates seven months annually, and carries over €1 million in senior obligations, while the seller retained board control and potentially held undisclosed debt claims against the asset.

Without audited statements showing actual purchase prices at each step in the ownership chain, there is no way for investors to verify whether the €6.36 million acquisition price represented fair market value or included markup from multiple related-party transactions.

Powerhouse Jugla: A Structural Analysis

Powerhouse Dambis was about overpaying for an asset. Powerhouse Jugla is about something much more elegant: creating the appearance of a transaction while ensuring retail investors provide actual cash that would be available to pay potential “transaction fees” to Ventus.

Ventus told investors it raised €10 million to acquire Powerhouse Jugla. From the announcement: “The acquisition of the powerhouse was completed in November of 2024, with a total acquisition price of EUR 10 million, 70% financed through Senior loan and 30% through Mezzanine loans.”

The same announcement states the asset’s valuation: €17.65 million for 100%, which means Ventus paid €10 million for a 48.99% stake worth €8.65 million. The owners at the time of the purchase were Sergejs & Kristīna Meļohins.

That’s a €1.35 million premium built into the headline number already. But the structure suggests the retail investors’ money may have had a different destination entirely.

Enter the pledge.

What exactly is a pledge? Think of a pledge like a mortgage on a house. If you stop paying, the bank takes the house.

Ventus said the powerhouse was ‘free of pledges prior to acquisition’. Source: https://ventus.energy/uploads/40_9_MW_Powerhouse_in_Riga_Operational_Round-presentation.pdf

That’s oddly specific in terms of the time-frame when it was pledge-free. So how long did it remain pledge free after acquisition?

Not even six weeks.

41 days after closing, a €9.65 million commercial pledge was registered in favor of the sellers, Sergejs and Kristina Meļohins, covering 49% of Juglas Jauda’s equity. The pledge grants the Meļohins the right to sell the shares without auction if Ventus defaults. Source: https://www.lursoft.lv/pledge/100208742 (Paywalled)

Investors who read quickly saw “free of pledges.” Investors who read the Latvian commercial register saw something very different.

Surely Ventus would only pledge investor-backed shares to the most reputable characters out there.

Right?

Right??

Oh no. Not again.

About those Meļohins: In December 2017, Latvian authorities placed an arrest on 100% of JUGLAS JAUDA’s shares, then valued at €426,710, as part of a criminal investigation. Registry records show the Riga Regional Police Criminal Police Department ordered the seizure “to ensure possible confiscation.” The restrictions were lifted by the Rīga District Prosecutor’s Office between November 2018 and January 2019, with no public record of charges being filed or court proceedings taking place. The nature of the underlying investigation remains unclear from public records.

The lifting of restrictions suggests the investigation concluded without charges. No wrongdoing was established, and the Meļohins are entitled to the presumption of innocence

But in a €10 million transaction, history matters. Most lenders would pause before handing control of the collateral to counterparties whose assets were previously seized by the Criminal Police.

Ventus investors weren’t given the chance to pause. They weren’t told at all.

What is clear: the same individuals whose shares were once frozen in a criminal probe are now the senior secured creditors on Ventus’s acquisition, funded by retail investors.

The Math

A €9.65M pledge for €7M in “senior financing” looks like a mismatch, until you factor in interest.

€7M at 6% compounded over 5.5 years comes to approximately €9.65M. The pledge doesn’t just secure the principal. It secures the entire obligation: principal plus every euro of interest over the loan term.

The Meļohins wouldn’t need cash at closing. They could wait for payment, with their full upside locked in from day one – way ahead of everyone else and while actually running the company. It’s as good as cash.

So if the acquisition didn’t need it, where did the €3 million from retail investors go?

Where The Money Could Have Gone

The loan agreement authorizes using funds for “the specific Project Stage, including related fees and costs specified in the Project Governance Documents.”

Those governance documents aren’t shared with investors. The fee amounts are whatever Ventus says they are.

Here’s how the structure works:

Step 1: Structure the deal so no cash changes hands with the sellers. The Meļohins accept deferred payment, that’s the “senior financing at 6%.” The €9.65M pledge secures principal plus interest. Ventus can truthfully say it “raised” €7M in senior financing the same way you “raise” a mortgage: not cash, but an obligation.

Step 2: Raise €3M from retail investors anyway.

Step 3: Deduct fees. The loan agreement explicitly permits deducting “fees and costs” before funds reach the project. Ventus can truthfully say investor funds were used “to finance the acquisition, including related fees and costs.” The fees just happen to flow to Ventus insiders.

The structure permits extracting the entire €3 million as fees. Every cent.

Well, almost. Ventus did kick back 5% to investors as a cashback bonus. So call it €2.85 million that’s available for “fees and costs”.

For anyone unfamiliar: cashback is a promotional incentive where platforms return a percentage of your investment immediately. Invest €1,000, get €50 back on day one. It feels like free money. It’s not.

In legitimate lending, cashback comes from a marketing budget: A customer acquisition cost, like paying for ads. In shadier operations, the “bonus” is carved out of the investment itself. You’re not being rewarded. You’re getting a small slice of your own money back while someone else pockets the difference.

The psychological effect is elegant. An investor sees 18% annual returns plus 5% immediate cashback and thinks: 23% in year one, incredible. It works especially well on otherwise cautious bargain hunters and analytical investors. The author speaks from experience.

Step 4: Launch an “Operational Round” for gas procurement, maintenance, and working capital, after the acquisition is already closed.

It’s like telling someone you’ll use their money to buy a car for them. Then giving the seller an IOU for the car, pocketing the cash as ‘fees,’ without ever handing over the car. Then coming back and asking for gas money.

The “Equity Buffer” That Wasn’t

Ventus marketed this deal with a 49% equity buffer protecting mezzanine investors. The 48.99% stake Ventus acquired was supposed to absorb losses before retail investors took a hit.

That stake is now pledged to the Meļohins for €9.65M, more than three times what retail investors contributed.

In any enforcement scenario, the Meļohins’ secured claim gets satisfied first. The “buffer” protects the sellers, not retail investors.

What Ventus Would Need to Disclose to Refute This

I’m not a forensic accountant. I don’t have access to bank records or internal agreements. What I have is public registry data, audited accounts, and Ventus’s own communications – and none of it adds up in a way that doesn’t suck for investors.

Maybe there’s an explanation. Maybe the €7M came from a real lender and the pledge is just backup security. Maybe the €1.88M in mystery debt was handled in some way that doesn’t appear in the documents. Maybe “cash-free, debt-free” means something specific in Latvian M&A that makes all of this innocent.

If so, Ventus could clear this up by disclosing:

- Evidence that €7M in cash was raised from an institutional lender

- The Share Purchase Agreement showing what happened to the cash

- The Project Governance Documents showing actual fee amounts deducted from investor funds

- The identity of the three lenders owed €1.88M on JUGLAS JAUDA’s balance sheet

- What happened to that debt in a “debt-free” acquisition

If Ventus has disclosed the cash amount paid to sellers at closing, as distinct from the “acquisition price”, I have not located it despite reviewing their public communications.

The Point

This isn’t about whether Timma did extract maximum value. It’s about a structure that permits it – and gives investors no way to verify he didn’t.

Every statement Ventus made was technically true. The acquisition raised €3 million. It closed cash-free, debt-free. More funding was needed for operations. All true.

None of it told investors their €3 million might have just been the transfer fee. Minus cashback of course.

And This Was the Plan All Along

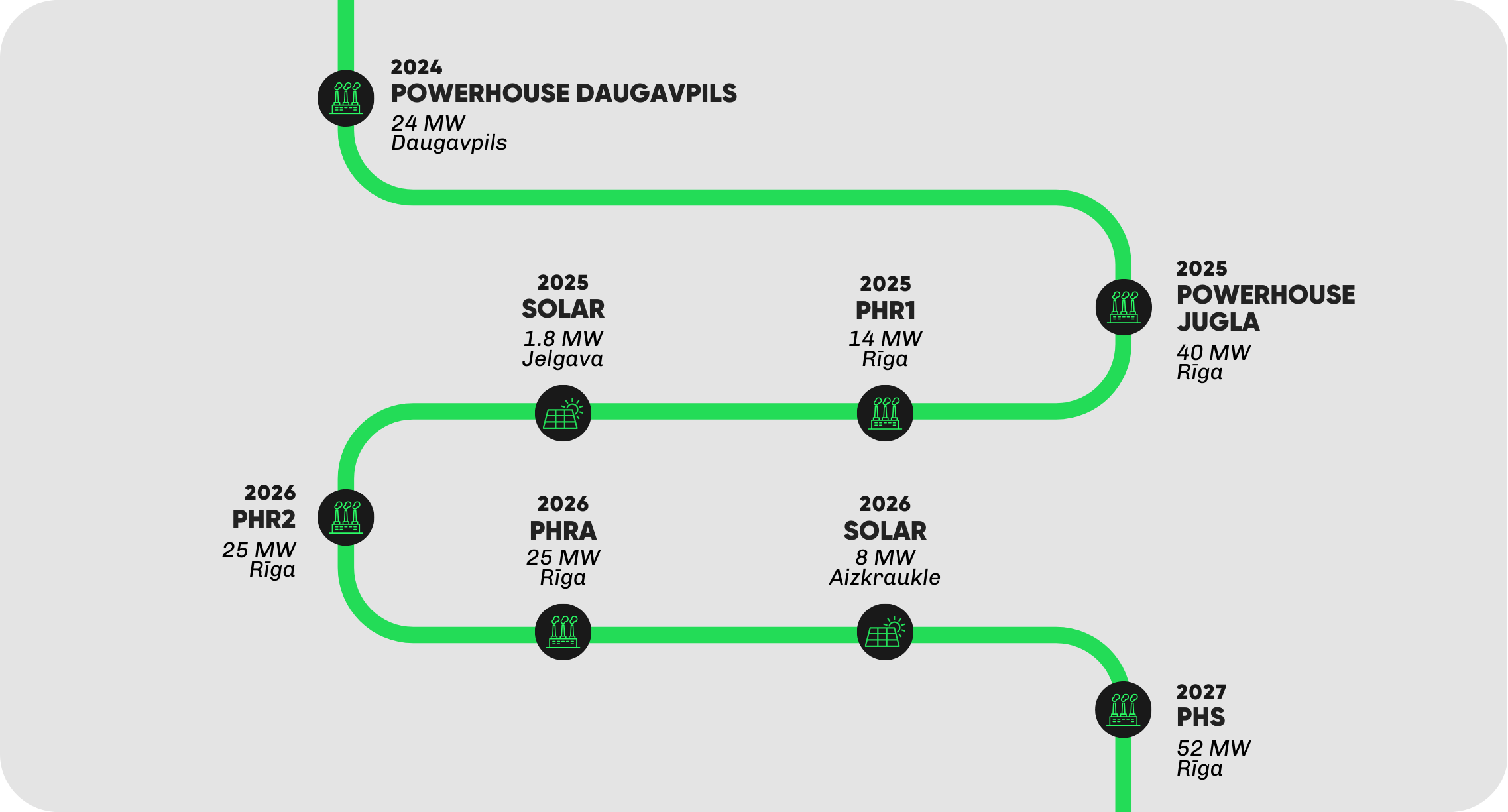

Ventus didn’t stumble into acquiring Timma’s assets. They announced it.

In their very first blog post, “Meet Ventus Energy”, Ventus published a roadmap of planned acquisitions. Source: https://ventus.energy/en/news/meet-ventus-energy

That roadmap lists Powerhouse Jugla by name, the 40 MW plant at the centre of the structure we just walked through.

It lists PHR1 (14 MW), which matches Powerhouse Dambis, one of the projects inside the “Powerhouse Riga” holding on Crowdestor. The biomass plant Timma contributed as his “skin in the game,” now sold to Ventus investors for €6.36 million.

This wasn’t opportunistic deal-making. It was the business plan from day one: use retail investor money to acquire assets Timma already controlled, at prices Timma’s team would set, validated by valuations Timma’s team would commission.

Chekhov said if you show a gun in the first act, it must go off by the third. Ventus showed us the gun. They just used an abbreviation for it. And didn’t mention it was pointed at investors.

How did nobody see this coming? There’s an entire cottage industry of influencers reviewing these platforms.

The Price of a Good Review: Equity

Ventus created a special-purpose vehicle called VENTUS Employee and Partnerships Stock Options OÜ (registry code 17067652). Incorporated on September 12, 2024 with nominal share capital of €100, this entity holds a 15% equity stake in Ventus Energy Group OÜ.

The name suggests employee stock options. The shareholder list tells a different story. Source: https://ariregister.rik.ee/eng/company/17067652/VENTUS-Employee-and-Partnerships-Stock-Options-O%C3%9C

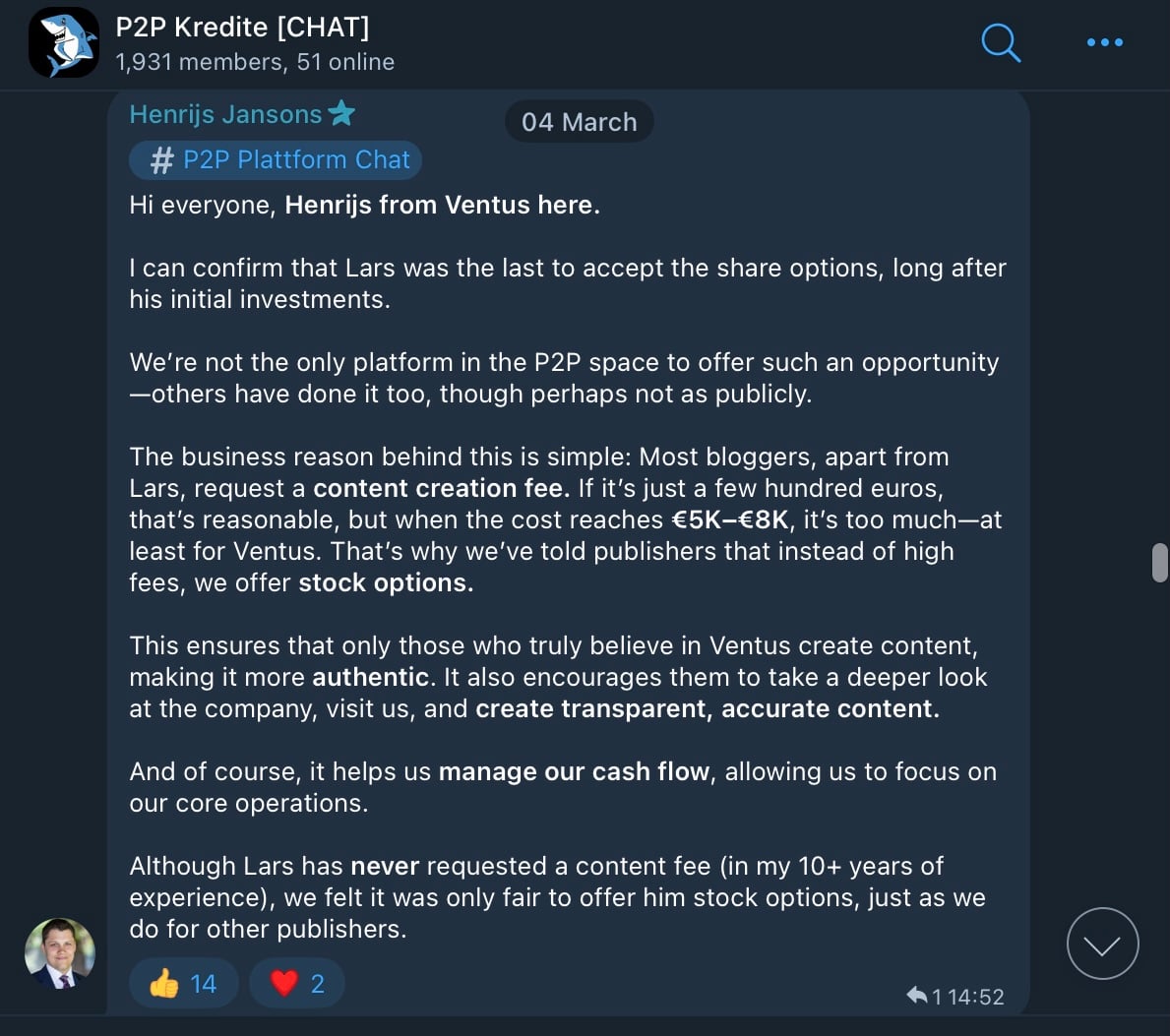

Ventus announced on Telegram why: “Most bloggers, apart from Lars, request a content creation fee. If it’s just a few hundred euros, that’s reasonable, but when the cost reaches €5K–€8K, it’s too much—at least for Ventus. That’s why we’ve told publishers that instead of high fees, we offer stock options.”

Between January and August 2025, seven prominent P2P bloggers and influencers became shareholders in Ventus through that options company. Five of them failed to disclose this equity stake on their Ventus reviews.

According to the Estonian Business Register, the seven influencer-shareholders are:

- Lars Christoph Wrobbel (Passives Einkommen mit P2P)

✅ Discloses ownership, percentage and approximate value:

https://passives-einkommen-mit-p2p.de/ventus-energy-erfahrungen/ (German) - Andreas Tielmann (p2p-anlage.de)

✅ Discloses ownership across all posts in the Ventus category:

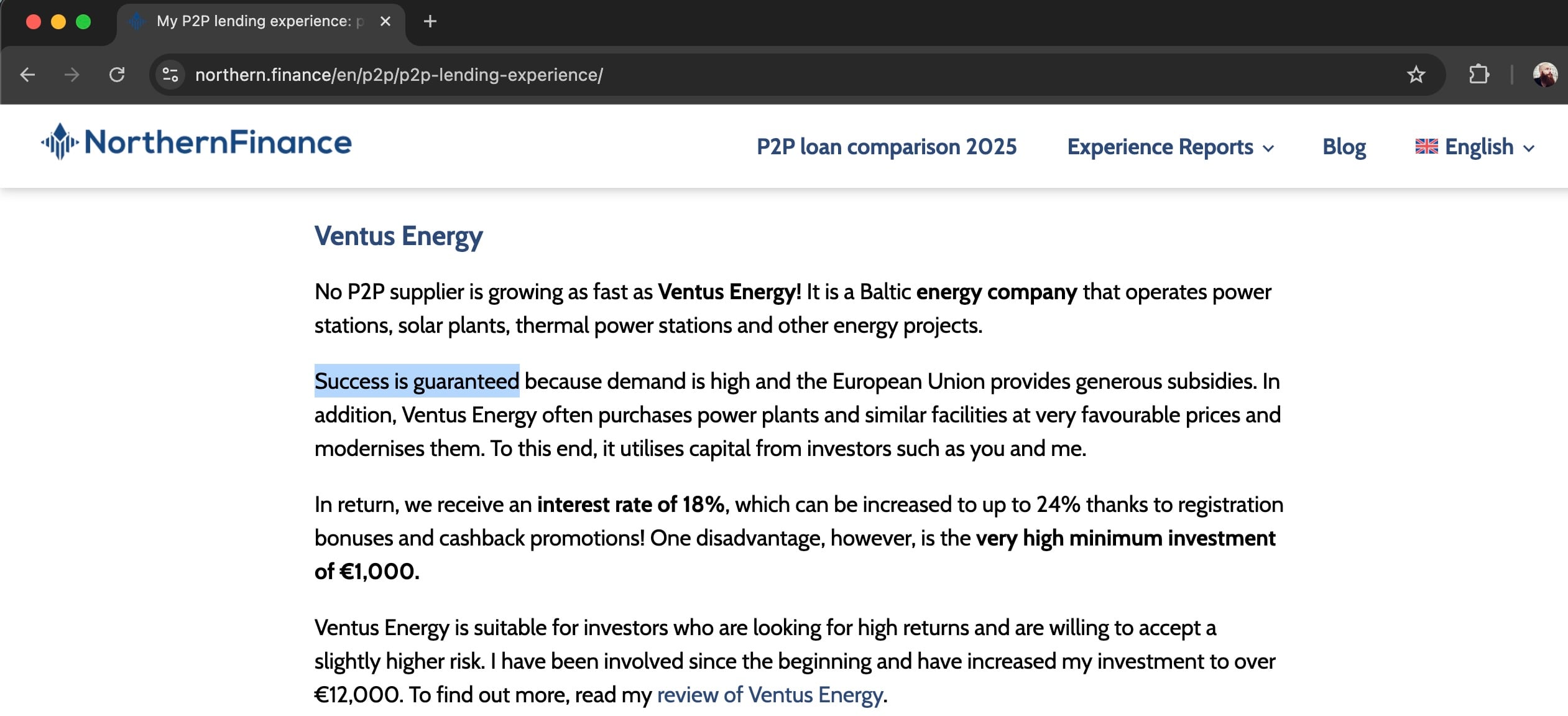

https://p2p-anlage.de/category/ventus-energy/ (German) - Aleks Antero Bleck (Northern Finance)

❌ No disclosure of equity in Ventus review:

https://northern.finance/en/review/ventus-energy-review/ - Jesús Arias Rebollal (TodoCrowdlending.com)

❌ No disclosure of equity in Ventus review:

https://todocrowdlending.com/ventus/ - Andreas Hollmotz (DividendenBackpacker)

❌ No disclosure of equity in Ventus review:

https://www.youtube.com/watch?v=ip7JW_gmAjA (German) - Maria del Carmen Corral Prado (Invertir en Préstamos P2P)

❌ No disclosure of equity in Ventus review:

https://www.invertirenprestamosp2p.com/ventus/ (Spanish) - Thomas Bernd Butz (P2P-Game.com)

❌ No disclosure of equity in Ventus review:

https://p2p-game.com/ventus-energy-erfahrungen

Lars Wrobbel, who runs the German P2P blog “Passives Einkommen mit P2P,” holds 3.33% of the options company (~0.50% of Ventus). The other six influencers each hold 0.67% (~0.10% of Ventus). Two Ventus employees also hold shares in the options company: Arvis Zelčs (1%) and Toms Ābele (1%). The remaining 90.65% stays with Jānis Timma. Source: https://ariregister.rik.ee/eng/company/17067652/VENTUS-Employee-and-Partnerships-Stock-Options-O%C3%9C

What 0.1% Buys You

Aleks Bleck from Northern Finance is probably the most prominent influencer in that list. He received 0.67% of the options vehicle, equivalent to roughly 0.1% of Ventus Energy Group. Here’s what Ventus got in return:

Ventus doesn’t appear in one Northern Finance article. It’s spread across at least 14 separate pages on the site: reviews, bonus pages, comparison tables, experience reports. On those pages we find Aleks describing Ventus with the following words:

- “I am fully convinced of Ventus Energy.” Source: https://northern.finance/en/review/ventus-energy-review/

- “I can highly recommend the platform.” Source: https://northern.finance/en/bonus/ventus-energy-bonus/

- And perhaps most remarkably: “Success is guaranteed” Source: https://northern.finance/en/p2p/p2p-lending-experience/

The ownership? Mentioned nowhere. Northern Finance carries standard affiliate disclaimers. The word “equity” never appears.

The other non-disclosing reviewers are no more restrained: wall-to-wall praise, prominent sign-up links, and not a word about the equity stake that makes the reviewer a direct beneficiary of every signup they generate.

Affiliate marketing is standard practice. An affiliate earns a commission when readers sign up. Equity ownership is different. An affiliate has no stake in whether the platform succeeds long-term. An equity holder does. When a reviewer becomes a part-owner, they have every incentive to downplay red flags that might harm future fundraising.

The most charitable interpretation is incompetence. A less charitable interpretation is that Ventus bought ads and the bloggers sold their credibility, with both sides knowing disclosure was required, and neither bothered. The least charitable interpretation would require those bloggers to have known about the issues documented in this article, all of which are based on publicly available information.

To be clear: there is no evidence that any of the influencers had prior knowledge of the issues documented in this investigation.

What is clear is that Ventus saw value in rewarding opinion-makers who could drive investor signups, and that this strategy paid off to the tune of €65.8 million raised from retail investors, many of whom likely discovered Ventus through reviews that never mentioned the reviewer owned a piece of the company.

The Short Version

Ventus Energy is a crowdfunding platform that has raised €65.8 million from nearly 5,000 retail investors across Europe, promising up to 18% returns on green energy projects.

I found:

The CEO doctored documents. Ventus raised money to buy “their office building.” It was actually the headquarters of Crowdestor, a failed lending platform where 69% of loans are in recovery. The CEO edited the valuation PDF to paste “Ventus Energy” over “Crowdestor” before sending it to investors. He forgot to flatten the file. The edit history shows his name on every change.

The founder is selling his own assets to his own platform. Jānis Timma owns 65% of Ventus. He also owned the power plants Ventus is buying with investor money. One plant earned €88,000 last year. Ventus paid €6.36 million for it, roughly five times what it’s worth.

Investor money may not be going where they think. In one deal, Ventus announced a €10 million acquisition. But the sellers didn’t get cash, they got an IOU secured by a pledge on the asset. The €3 million raised from retail investors? The loan agreement allows it to be used for “fees and costs.” The fee amounts aren’t disclosed.

The company probably shouldn’t be allowed to do this at all. Ventus has no lending license, no crowdfunding authorization, and isn’t registered with any financial regulator. It has €4,166 in capital, zero employees, and is registered as a “web portal.” Estonian law requires authorization to take repayable funds from the public. Ventus claims an exemption, while publicly marketing to thousands of investors.

They paid influencers in equity. Seven P2P bloggers who review platforms like Ventus became shareholders. Five of them didn’t disclose this when recommending Ventus to their readers.

The full investigation above includes registry records, audited financial statements, and the original doctored PDF. Everything is sourced and verifiable.

Disclosure

A quick thank you: This article wouldn’t have been possible without the help of the BeyondP2P community who helped by sharing documents relating to their own investments as well as pointers to official information sources that helped verify several key details in this review.

Note on Sources: This investigation is based on publicly available registry data from Latvian and Estonian business registers, Ventus Energy’s public communications and campaign materials, and archived Crowdestor project pages. Where paywalled registry services (Lursoft, Ariregister) are cited, specific data points are referenced. Company ownership structures, shareholder changes, and commercial pledges are drawn from official registry records.

If you notice any links being broken or the files having changed: I created time-stamped archived copies on the usual internet archives (archive.org, archive.ph, etc.), so you can check those or contact us to receive a digital copy as it existed at the time of writing.

Legal inquiries: In addition to public archive posts, I made time-stamped, third party verified backups of all cited company sources and influencer content. Should you require access to those for any legal purpose. Please contact me. Same goes for inquiries of any other nature.

About the Author

Karsten is not a financial advisor, journalist, or professional analyst. He’s a former entrepreneur and stay-at-home parent whose hobbies include long walks, strong coffee, and a tendency to hyperfocus on financial anomalies in spreadsheets until they resolve themselves, sometimes more dramatically than expected.

Change Log and Updates

Below you will find an overview of changes made to this article post publication as well as documentation of new documents and statements that have been released by Ventus, the author and third parties in regards to this report.

30 December 2025

- On December 23 Ventus presented a document as ‘audit’ before they had to retract that claim. My full take on this is available here: https://www.karsten.me/money/ventus-hired-an-audit-firm-to-not-perform-an-audit/

11 December 2025

- Jakub from P2P Empire has published an excellent recap of key findings of this article and Ventus’ response in a YouTube short here: https://www.youtube.com/shorts/hmtrXnIjbzE

5 December 2025

- Adding an additional disclaimer upon a reader’s request: “BeyondP2P received affiliate revenue from Ventus. The author has a financial stake in BeyondP2P. He published this anyway.

2 December 2025

- Following publication, several influencers as have reacted by adding disclaimers. Popular archive sites retain older versions.

- An earlier version of this article incorrectly stated that Ventus had already replaced the modified valuation file on their server.

- Ventus now has responded to this article. Their response together with my comments on the points they brought up can be viewed here.

Want to stay up to date on new developments? I don’t have a mailing list, but I tend to post updates in the BeyondP2P Telegram group, where I also sourced some of the documents for the Ventus investigation.