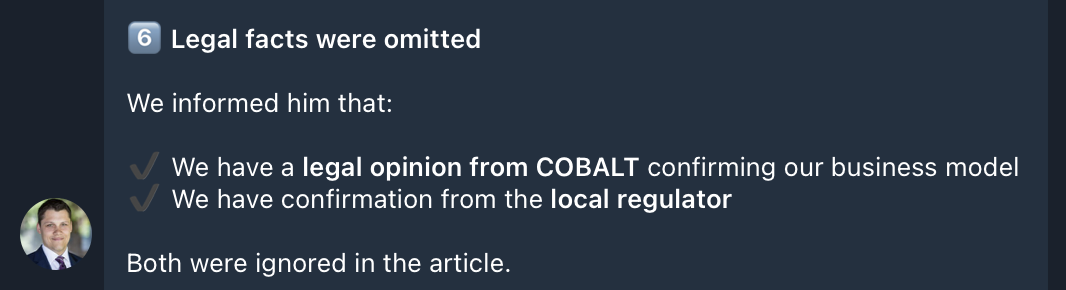

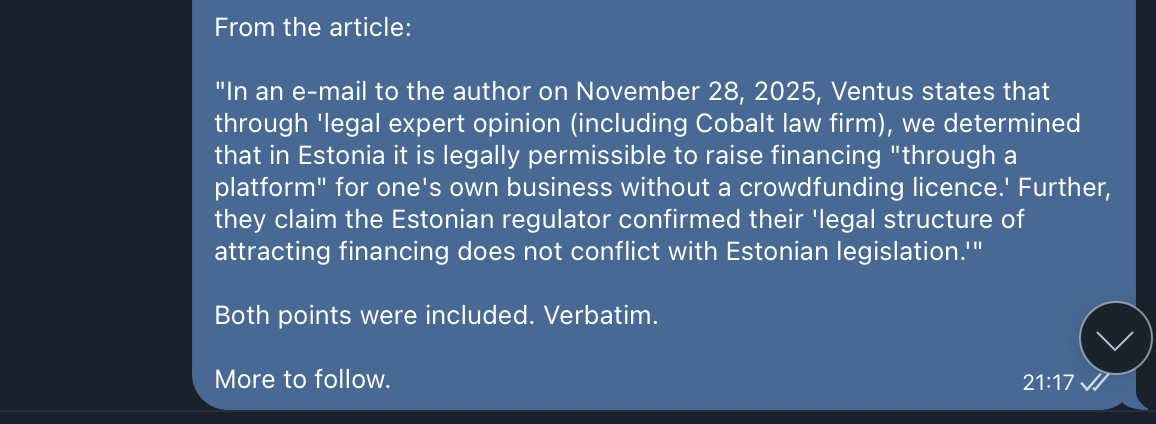

Ventus claimed that material claims they sent to me were not featured in the article. The first such claim was quickly disproven by citing the article itself.

For those that don’t remember, this one was worth screenshotting. Here’s Ventus CEO Henrijs Jansons:

And here was my response:

However, the company continues to claim that some their input wasn’t used. And they’re right. It wasn’t. And it should have been. What they were wrong about: that this would make them look better.

Below are all questions sent to Ventus as well as the answers they provided. Highlights were added by me and the formatting of the text was standardized; the actual answer text is unedited, unabbreviated, and directly copied from the e-mails they sent me.

The first round of questions was sent on November 6th. Ventus replied 7 days later on November 13th.

Question #1

When will the audited 2024 financial statements for Ventus Energy Group OÜ be published on the Estonian e-Business Register?

Ventus’ Answer

There will be no audited company reports for 2024, as the company only began operations in September 2024. Audits are planned for the energy assets under the company’s management, as well as a parent company audit for the year 2025.

Karsten’s Comment

See the highlighted part. Moving on.

Question #2

Can you provide the loan agreements and security documentation that legally prove investments are secured against specific assets and are not simply an unsecured loan to the parent company?

Ventus’ Answer

The Loan Agreement does not state that the investment is secured against specific assets, but it does specify that the parent company lends the invested amount to the subsidiary under the same terms. The subsidiary is the owner and developer of the respective energy asset/project. Therefore, the investment is secured by the subsidiary’s assets, and the parent company also assumes a buyback obligation in case the subsidiary is unable to meet its liabilities.

Karsten’s comment

Ventus states that “the investment is secured by the subsidiary’s assets.”

The Latvian Commercial Pledge Register shows those same assets were pledged to the sellers for €9.65 million.

Both statements cannot simultaneously be true.

Question #3

Can you provide a legal declaration confirming that none of the assets currently being financed have any prior, unresolved financial claims or encumbrances from investors on the Crowdestor platform?

Ventus’ Answer

We can confirm that none of the assets currently being financed on Ventus Energy have any prior, unresolved financial claims or encumbrances from investors on the Crowdestor platform!

We don’t have such a legal declaration prepared.

Karsten’s Comment

That’s hard to square with the accounts. Eco Energy Riga shows €160,943 owed to AS White House Capital – the same holding company that managed Crowdestor-funded projects. Whether that debt traces directly to Crowdestor investors, only Ventus can say. But “no prior financial claims” seems optimistic given the intercompany liabilities still on the books.

The second round of questions was sent to Ventus on November 15th. Ventus replied 12 days later on November 27th. In my e-mail I actually numbered my questions again starting from “1”, but for easier readability, I’m continuing numbers from the first e-mail.

Question #4

Your e-mail notes that “the parent company also assumes a buyback obligation.” Since the investor’s loan agreement is already with the parent company (Ventus Energy Group OÜ), this entity is already the primary debtor. Could you explain how this “buyback obligation” creates any additional layer of protection for the investor beyond the OÜ’s existing obligation to repay the loan?

Ventus’ Answer

The Lender–Borrower agreement states that the parent company undertakes to lend the lender’s funds to a specific subsidiary (project) on the same terms (clause 2.1.6.). As a result, the actual lender’s funds are directed to that specific project. The full and timely repayment of the lender’s funds is therefore directly dependent on the performance of the particular subsidiary.

Consequently, clause 6.6 of the agreement reinforces the Group’s responsibility (both as the borrower and as the parent company) for each loan and ensures that no legally complex structure is created that would relieve the parent company of liability in the event of the subsidiary’s insolvency.

Karsten’s Comment

That’s a lot of words to say:

“The buyback guarantee means absolutely nothing.”

Question #5

Ventus Energy Group OÜ shows zero employees on record in the Estonian business registry. Who carries out day-to-day operations such as loan underwriting, asset management, and investor support? Are these functions handled by another Ventus entity, external contractors, or a different arrangement?

Ventus’ Answer

The operational personnel are dispersed among Ventus Energy Group subsidiaries or sister companies, including entities such as AML PRO and White Label Solution. These affiliated companies provide the functional capacity – covering analysis, project management, compliance, and client/investor support – while the subsidiaries primarily serve as administrative and of course powerplants management and operational capacity.

Karsten’s Comment

The purpose of the question was to get Ventus on the record to specify exactly which companies handle the day-to-day operations. It’s obvious that if those companies aren’t subsidiaries of Ventus themselves, they can’t be touched by investors.

That would mean if the Estonian holding collapses, they can just continue to run the operations from Latvia and just start a new company.

This isn’t hypothetical. It’s what happened. Crowdestor collapsed. Ventus launched.

Nobody in Latvia had to even move offices.

Question #6

What is the business and legal rationale for routing investor contracts through the Estonian OÜ instead of having investors lend directly to the project-owning subsidiaries? Understanding this structure would help clarify how investor funds flow and where risks actually reside.

Ventus’ Answer

Answer: Before starting operations, Ventus Energy analysed project financing legal framework. Since the goal was (and still is) to raise the funding solely for the company’s own projects, a crowdfunding licence was not suitable, as such licence requires the platform to raise funds only for businesses not connected to the platform itself. Therefore, we explored other legal solutions.

Based on some legal expert opinion (including Cobalt law firm), we determined that in Estonia it is legally permissible to raise financing “through a platform” for one’s own business without a crowdfunding licence. A few months after launching Ventus operations, we also received opinion from the Estonian regulator that our legal structure of attracting financing does not conflict with Estonian legislation. If Ventus Energy had obtained the same confirmation regarding Latvian legislation (in an earlystage), the company would register its activities in Latvia (where the core operations take place). Currently, while working with both Estonian and Latvian regulators to register an Investment Fund Management Company. The Bank has approved the request (in mid-November), and now work on the procedure, etc, development has started.

Karsten’s Comments

This one is interesting. Let’s take it apart:

- Based on some legal expert opinion (including Cobalt law firm), we determined that in Estonia it is legally permissible to raise financing “through a platform” for one’s own business without a crowdfunding licence.

Ventus originally claimed I omitted this from the article. I quoted it verbatim. Either they didn’t read their own coverage, or they let an AI draft their response without fact-checking.

Either way: grain of salt on anything Ventus says about what’s in the article.

- A few months after launching Ventus operations, we also received opinion from the Estonian regulator that our legal structure of attracting financing does not conflict with Estonian legislation.

Read that carefully. “Our legal structure of attracting financing does not conflict with Estonian legislation” sounds reassuring. It isn’t.

That could mean: “Yes, an OÜ is allowed to borrow money.”

It almost certainly doesn’t mean: “You can publicly solicit 5,000 retail investors across 25 countries via influencer marketing and Telegram while claiming a private placement exemption.”

One of those things was run by the regulator.

The other is what Ventus actually does.

Question #7

Ventus states that 60 to 80% of project funding comes from institutional lenders or banks. Could you provide the names of at least two such institutional partners, or alternatively, any documentation confirming the source of senior debt for current projects?

Ventus’ Answer

For clarification, Ventus medium-term objective is to reach a point where 60–80% of total financing (closer to 80%) comes from senior lenders. Given that Ventus is currently in a rapid growth and development phase, the share of senior financing is proportionally lower. This is primarily because senior lenders are generally reluctant to finance projects that are still in the development stage.

At the same time, even after just one year of operations, we are in the final stage of negotiations with one of the banks in Latvia regarding its approx. EUR 20 million in financing. This funding would be used for both new project development and refinancing some existing obligations. This confirms that Ventus chosen model (start development-stage projects with mezzanine financing and then bring in senior lenders) is both effective and sustainable.

All projects that Ventus has acquired in a fully operational stage – PH Dambis, PH Jugla, PH Smiltene, and the Valmiera Solar Park – are partially financed by senior lenders.

In the case of the Valmiera Solar Park, the senior lender is ALTUM (ALTUM is Latvia’s national development finance institution, established by the government to support strategic economic sectors and promote sustainable growth. It provides state-backed loans, guarantees, and investment instruments that complement commercial financing. ALTUM plays a key role in enabling renewable energy and infrastructure development across the country) which provides funding at an interest rate of 2.8% per annum.

For other projects, senior lenders are not commercial banks or credit funds, but industry players. Our agreements restrict us from disclosing their identities. However, for example, the senior financing for PH Smiltene carries an interest rate of 2.9% per annum.

Karsten’s Comment

Another round of Ventus hinting at one thing while technically not lying:

- Ventus medium-term objective is to reach a point where 60–80% of total financing comes from senior lenders…

“Medium-term objective” means: we’d like to, but we haven’t. They’re not saying what they actually have.

- “Even after just one year of operations, we are in the final stage of negotiations…”

Translation: we want to, but haven’t.

- “All projects that Ventus has acquired in a fully operational stage… are partially financed by senior lenders.”

“Senior lender” means exactly one thing: they get paid before you do. It says nothing about whether they’re reputable, independent, or even unrelated to Ventus. Sounds reassuring. Isn’t.

- “Our agreements restrict us from disclosing their identities.”

No.

Non-disclosure agreements do not cover information that is already public. And in this case, the ‘confidential’ senior lender is listed, by name, in the Latvian Commercial Pledge Registry.

You can’t retroactively make public data secret just because it’s inconvenient.

The Author’s Take

Most statements Ventus made about their current situation were either contradicted by public records or simply did not improve their position. Not publishing their responses, if anything, made them look better than they deserved.

They wanted their input included. Here it is.

Want to stay up to date on new developments? I don’t have a mailing list, but I tend to post updates in the BeyondP2P Telegram group, where I also sourced some of the documents for the Ventus investigation.